Rebuttal to AQR – Not to Hype, But to Inform

BufferLABS Response to AQR Blog Post: “Rebuffed: A Closer Look at Options-Based Strategies” Dated March 21, 2025 - Cliff Asness and Daniel Villalon

https://www.aqr.com/Insights/Perspectives/Rebuffed-A-Closer-Look-at-Options-Based-Strategies

As a new research publisher and participant in the buffered ETF ecosystem, BufferLABS aims to shed light on these hedging instruments using data and facts—nothing more, nothing less. So, we read AQR’s critique of buffered ETFs with keen interest. While we respect AQR’s perspective, we find their piece largely misrepresents what buffered ETFs are designed to achieve in this growing niche. We also recognize that buffered ETFs, part of the broader ETF revolution that’s claimed significant market share from mutual funds over the past 25 years, pose a strategic challenge to firms like AQR. This context may explain their aggressive stance, but it doesn’t justify the distortions in their argument.

AQR opens with a strawman: “The holy grail for many investors is a strategy that generates market-like returns, but with less risk. Enter options-based strategies, often labeled with words like ‘Buffered,’ ‘Overlay,’ and ‘Defined Outcome.’” This framing slyly implies buffered ETFs promise “market-like returns” alongside downside protection—a claim we’ve never seen in marketing materials from providers like First Trust or Innovator. Instead, the clear focus of buffered ETFs is to limit downside risk in exchange for capping upside potential. The proposition is straightforward: how much downside are investors willing to tolerate, and how much upside can they capture given that trade-off? This flexibility, tailored to individual risk preferences, is why buffered ETFs have attracted $60 billion in just a few years. We believe they’re on a trajectory to rival traditional ETFs, potentially surpassing $1 trillion in assets. AQR’s critique, by muddling this purpose, does a disservice to investors seeking clarity.

Because AQR attacks a misrepresentation, much of its analysis—comparing buffered ETFs to the S&P 500 or a passive equity/T-bill mix—misses the mark. Of course, these ETFs haven’t outperformed the S&P 500 over the past five years; they’re not meant to. The market’s been on a tear, and buffered ETFs deliberately sacrifice some upside for protection against severe drawdowns—think October 1987, 2000-2003, or 2008-2009. Since most buffered ETFs are relatively new, let’s test AQR’s thesis against recent history: the volatile 2022-2023 period.

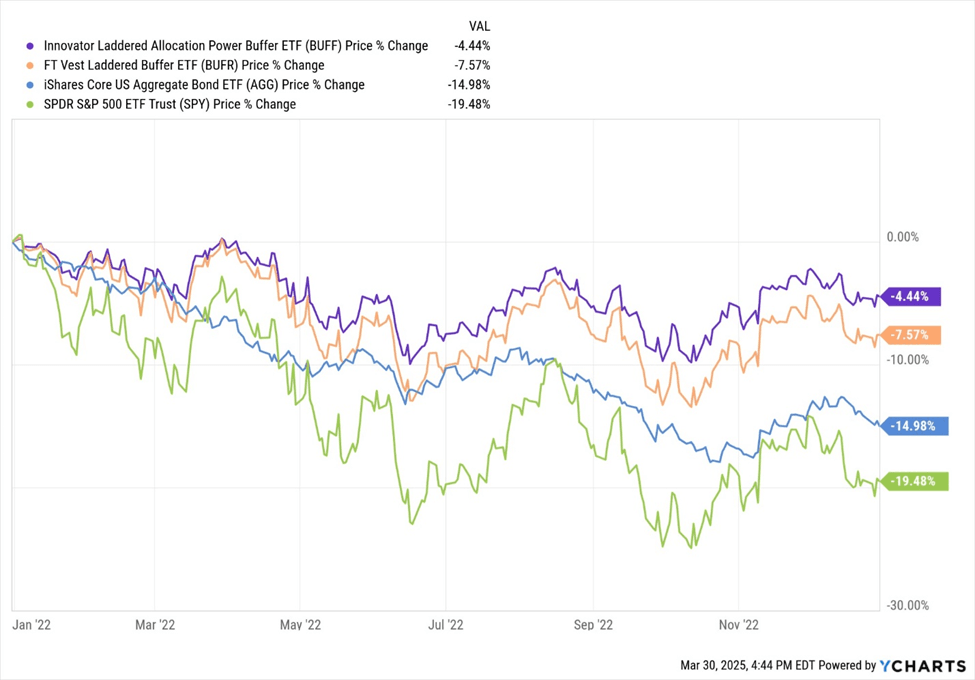

In 2022, a brutal year for equities with the S&P 500 (SPY) dropping 19.48%, laddered buffered ETFs like First Trust’s BUFR and Innovator’s BUFF shone. BUFF limited downside capture to about 25% (a -4.5% return), while BUFR captured 40% (-7.6%), far outperforming SPY’s unhedged loss. Even against a 60/40 portfolio (down roughly 17% in 2022), these ETFs delivered superior protection.

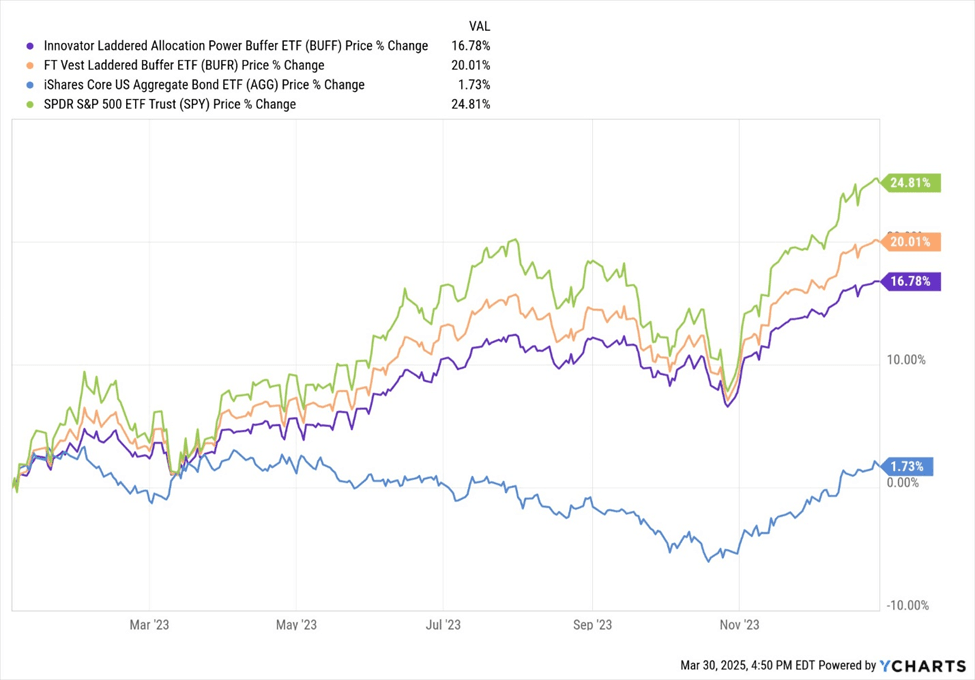

Then, in 2023’s rally—SPY up 24.8%—BUFR captured 80% of the upside (20% return), and BUFF captured 64% (16.8%).

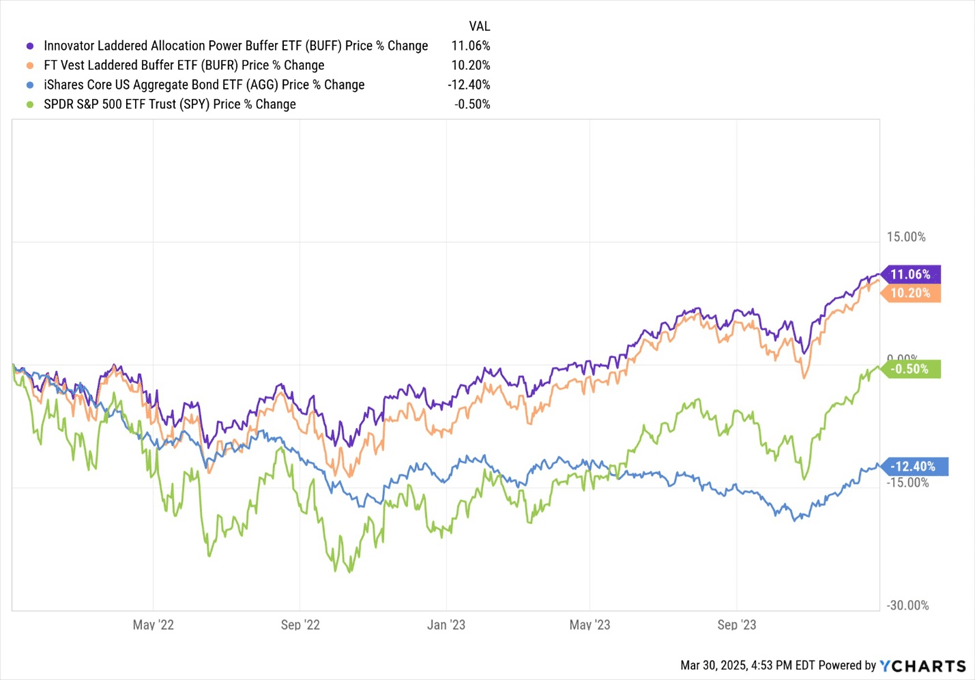

Over the two-year stretch, BUFF returned roughly 10.2% and BUFR 11% cumulatively, while SPY was still underwater at -0.5%. Ask investors in these ladders if they’d take modest gains over a wipeout-and-recovery cycle, and we’re confident most would say yes.

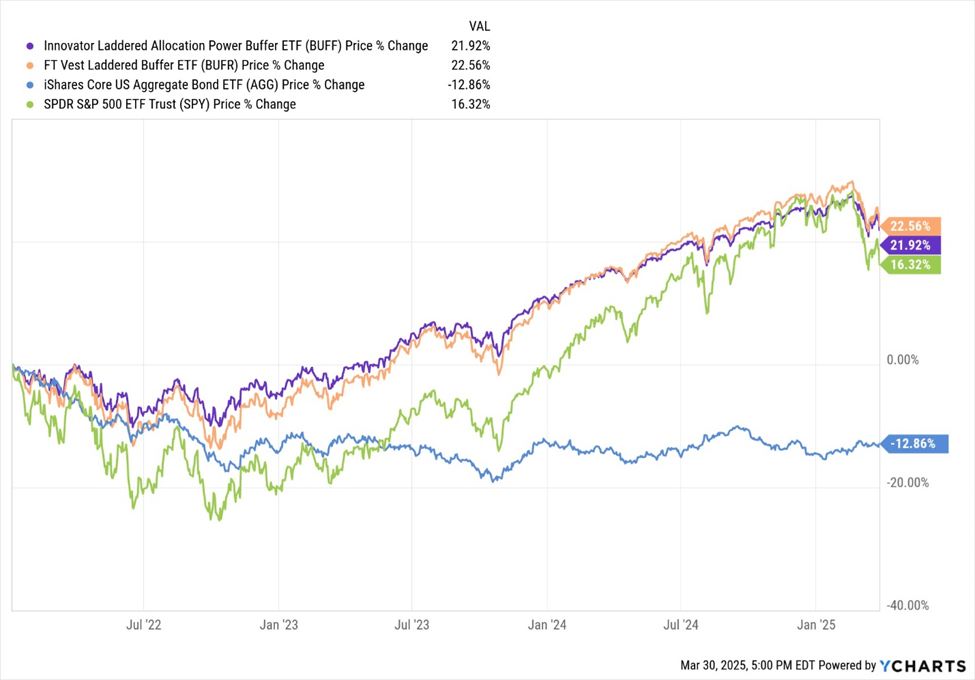

Zooming out today, March 30, 2025, the picture looks like this:

We acknowledge in a long bull market and over an extended time, unhedged equities will eventually overtake buffered ETFs as upside caps bite. We also know our analysis is affected by beginning period dependency (we started our analysis in 2022-a down year.) But nonetheless, in bear markets, buffered ETFs shield investors from the worst—precisely their advertised purpose. AQR’s benchmark of a static equity/T-bill mix ignores this dynamic. A 70/30 portfolio might soften a crash, but it won’t adapt to market swings like a buffered ETF’s options structure can. And while AQR touts diversification as “Option C,” buffered ETFs are a diversification tool, offering equity exposure with a built-in hedge—something T-bills alone can’t replicate. (As the old saying goes, cash doesn’t rally.)

AQR’s theory—that options premiums make these strategies a “bad deal”—also oversimplifies. Yes, puts cost money, and caps limit gains. But investors aren’t buying buffered ETFs for a free lunch; they’re paying for insurance against tail risks. The $60 billion in assets suggests investors see value in that trade-off, not in chasing S&P 500 returns. By focusing on long-term underperformance versus an unhedged index, AQR sidesteps the real question: do buffered ETFs deliver on their promise of downside protection when it matters? The 2022-2023 data says yes.

We at BufferLABS acknowledge that buffered ETF’s are not perfect, and many things about them require analytical attention and active management. This is precisely why we have launched our company; to help investors navigate them better. As this category grows, we at BufferLABS will keep digging into the data—not to hype, but to inform.

Comments