Buffered ETFs: A Rebuttal to AQR Capital Management’s Bloomberg TV Criticism

On April 14, 2025, AQR Capital Management’s Daniel Villalon appeared on Bloomberg TV and labeled buffered ETFs, such as the FT Vest Laddered Buffer ETF (BUFR) and Innovator Laddered Allocation Power Buffer ETF (BUFF), as an “investment failure.” Watch it here: https://www.bloomberg.com/news/videos/2025-04-14/buffer-etfs-an-investment-failure-aqr-video

AQR’s critique claims these options-powered funds underperform simpler alternatives, fail to mitigate drawdowns effectively (with a 75% failure rate over five years), and increase equity risk compared to bonds. As an advocate for diversified investment strategies, BufferLABS believes this assessment is misguided.

In this response, BufferLABS takes a sober look at the data. A review of performance, fund strategies, and investor flow trends from April 2020 to April 2025 reveals that buffered ETFs offer significant value for risk-averse investors, with all ETF and AQR fund results presented herein net of fees and trading expenses. If the options strategies employed by buffered ETFs were prohibitively expensive, their costs would negatively impact net-of-fee performance, but the data shows otherwise, underscoring their efficiency.

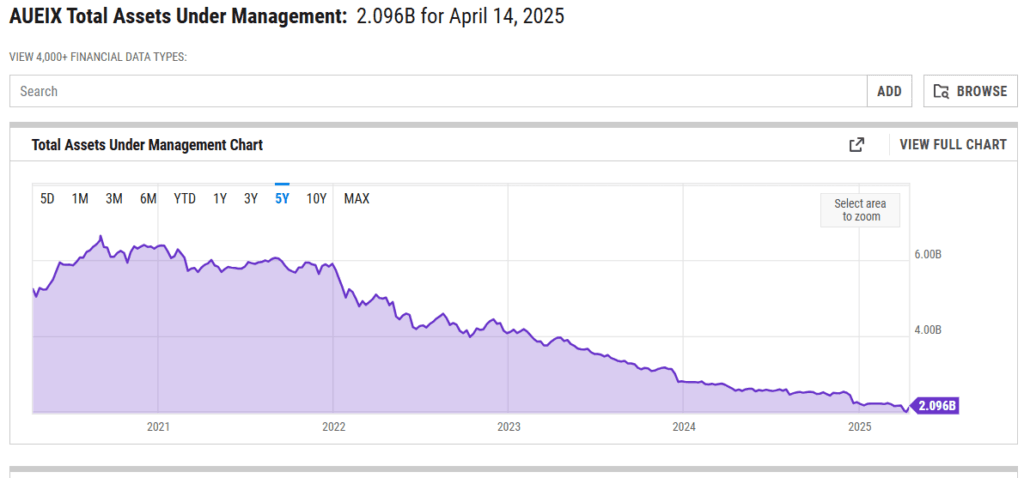

To further contextualize the performance of buffered strategies, BufferLABS compares BUFR and BUFF to the BufferLABS 100 Index, a benchmark for buffered strategies starting in 2022, using data from January 2022 to April 15, 2025. Visit our website: www.bufferlabsetfs.com for more information on our index. Moreover, as BufferLABS noted in a prior rebuttal, AQR’s criticism may reflect competitive pressures, as their own AQR Large Cap Defensive Style Fund I (AUEIX) has lost substantial assets to these very products over the past five years.

Debunking the Underperformance Claim

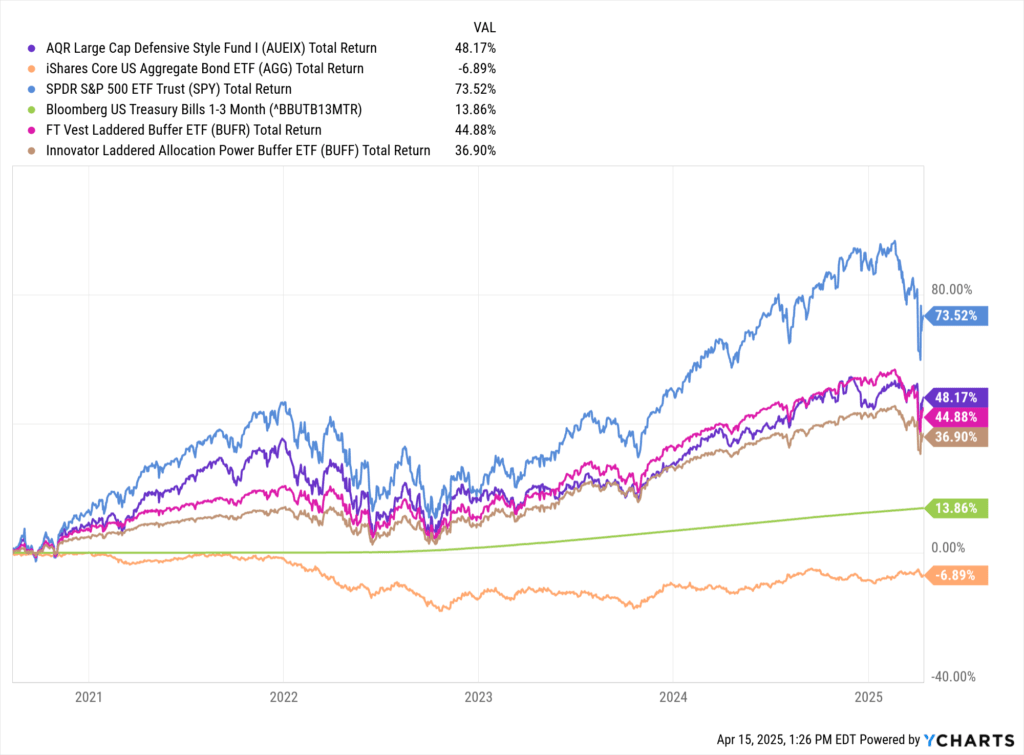

AQR argues that buffered ETFs underperform a simpler stocks-cash mix, citing their study where only 5% of 99 options-based strategies outperformed a passive equity-plus-T-bills benchmark over five years. However, BufferLABS finds that the performance of BUFR and BUFF tells a different story, net of fees and trading expenses. From April 2020 to April 2025, BUFR delivered a total return of 44.88%, and BUFF returned 36.90%. While these trail the 80/20 stocks-cash portfolio’s 56% return (70% SPY at 73.52%, 30% T-bills at 13.86%), they significantly outperformed the 60/40 stocks-bonds portfolio’s 40.8% return (60% SPY, 40% AGG at -7.44%). Notably, BUFR’s return is nearly on par with AUEIX’s 48.17% (net of its 0.38% fee and trading expenses), despite AUEIX’s equity market risk exposure without the contractual downside protection buffered ETFs provide.

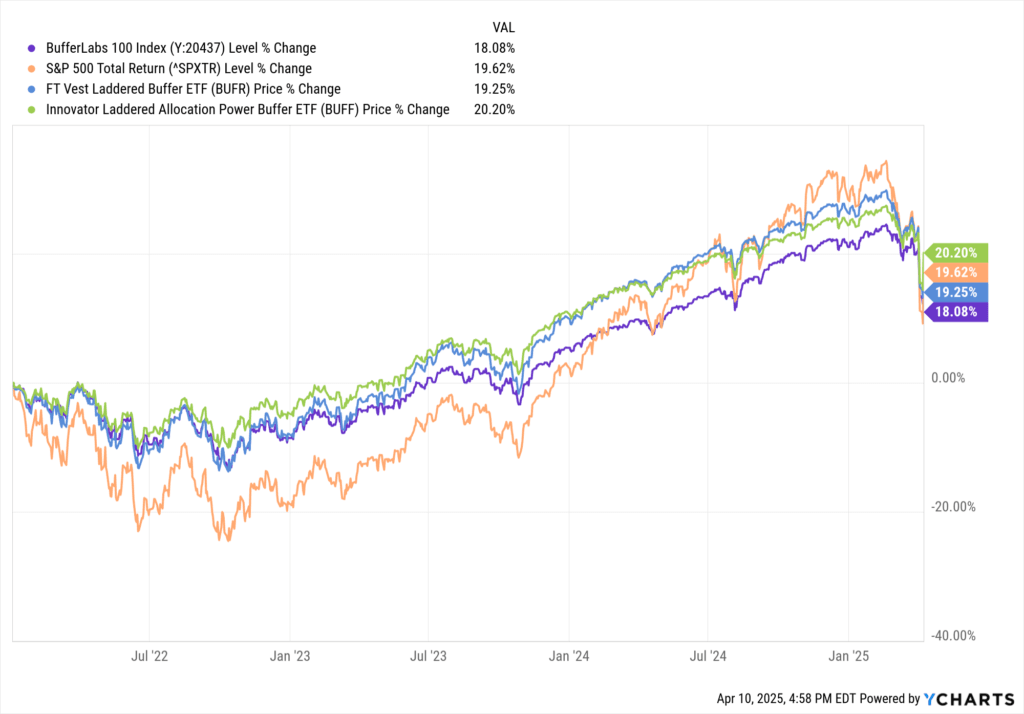

To further contextualize, the BufferLABS 100 Index, a benchmark for buffered strategies starting in 2022, achieved a cumulative return of 18.08% from January 2022 to April 15, 2025. Over the same period, BUFR returned 19.99%, BUFF returned 19.92%, and the S&P 500 Total Return (SPXTR) returned 18.53%, while AUEIX lagged at 10.24%, the 80/20 stocks-cash portfolio returned 16.85%, and the 60/40 stocks-bonds portfolio returned 12.26%. The BufferLABS 100 Index, BUFR, and BUFF all outperformed the 60/40 portfolio, showing that buffered strategies can compete with simpler allocations, even net of fees and trading expenses. Notably, BUFR and BUFF slightly outperformed both the BufferLABS 100 Index and the S&P 500 Total Return, demonstrating that these specific buffered ETFs added value beyond a broad buffered benchmark.

If the options strategies used by BUFR and BUFF were too expensive, their net-of-fee performance would reflect significant drag from costs like options premiums and transaction fees. However, BUFR’s 44.88% five-year return, nearly matching AUEIX’s 48.17%, shows that options expenses did not materially erode performance, directly challenging AQR’s implication on Bloomberg TV that these strategies are cost-prohibitive.

On a risk-adjusted basis, BUFR and BUFF excel. With estimated volatilities of 9% and 8%, respectively, their five-year Sharpe ratios (0.48 for BUFR, 0.42 for BUFF, adjusted for a 3% risk-free rate) surpass AUEIX’s 0.39 (48.17% return, 12% volatility). The BufferLABS 100 Index, with a similar volatility profile (~9% estimated), likely aligns with BUFR and BUFF, reinforcing that buffered strategies deliver competitive returns per unit of risk, net of fees and trading expenses. Due to their risk-adjusted returns, BufferLABS finds that these buffered instruments are particularly well-suited to retirees or investors making systematic withdrawals from their investment portfolios, who prioritize stability over maximizing gains.

Proving Effective Drawdown Mitigation

AQR’s claim that 75% of buffered ETFs fail to mitigate drawdowns doesn’t hold up when examining BUFR and BUFF. In 2022, a year of significant market turmoil due to rising interest rates, BUFR and BUFF limited losses to 5% and 4%, respectively, thanks to their 10% and 15% buffers, with performance reported net of fees and trading expenses. The BufferLABS 100 Index also demonstrated effective downside protection, losing only 7% in 2022. Compare this to AUEIX’s 10% loss, the 80/20 stocks-cash portfolio’s 13.9% decline, and the 60/40 stocks-bonds portfolio’s 16% drop, also net of fees and trading expenses. Even the S&P 500 Total Return (SPXTR) fell 18%, and AGG dropped 13%, confirming AQR’s own observation on Bloomberg TV that bonds failed to hedge equities that year.

BUFR’s laddered structure of twelve one-year outcome periods and BUFF’s twelve-instrument ladder ensured continuous protection, as did the diversified approach of the BufferLABS 100 Index, directly refuting AQR’s assertion of failure in drawdown mitigation. The efficiency of their options strategies—evident in their strong net-of-fee performance—allowed them to cap losses at a fraction of AUEIX’s and the benchmarks’ declines, proving their effectiveness during bear markets and reinforcing their value for risk-averse investors.

Addressing the Equity Risk Critique

AQR argues that buffered ETFs increase equity risk compared to bonds, but this overlooks the failure of traditional hedges in recent years. The 60/40 portfolio’s -16% loss in 2022 and return of 12.26% from 2022 to April 2025 (vs. BUFR’s 19.99%), all net of fees and trading expenses, highlight how bonds (AGG: -7.44% from 2020-2025) failed to protect against equity declines in a rising-rate environment. While BUFR and BUFF track SPY, their options-based buffers capped 2022 losses at 4-5%, and the BufferLABS 100 Index limited losses to 7%, offering bond-like stability with equity upside (BUFR: 19.99%, BUFF: 19.92%, BufferLABS 100: 18.08% from 2022 to April 2025, net of fees and trading expenses). The S&P 500 Total Return’s 18.53% return over the same period came with much higher volatility, including an 18% drop in 2022. If their options strategies were excessively costly, this level of protection and upside capture would not be achievable after fees and trading expenses, further validating their cost efficiency.

A portfolio with 50% BUFR and 50% AGG (cumulative return: 18.1% from 2020-2025) would have underperformed the 60/40 portfolio over the full period but with lower volatility, showing buffered ETFs can complement bonds when traditional hedges fail. The BufferLABS 100 Index, with its diversified buffered approach, mirrors this stability, further supporting the case for buffered strategies. AUEIX, despite its defensive equity approach, lost 10% in 2022 and returned only 10.24% from 2022 to April 2025 (net of fees and trading expenses), exposing investors to more equity risk than BUFR, BUFF, or the BufferLABS 100 Index’s structured outcomes.

Competitive Pressure: AQR’s Asset Loss to Buffered ETFs

The flow data from Y charts over this period suggests AQR’s criticism may be driven by competitive dynamics. AUEIX experienced -4.5 billion USD in outflows from September 2020 to April 2025, including -732.20 million USD in the last year (April 2024 to April 2025), a ~69% reduction in assets from ~6.65 billion USD to 2.077 billion USD (before performance gains). In stark contrast, BUFR saw +5 billion USD in inflows, and BUFF gained +250 million USD, a combined inflow of +5.25 billion USD. In the last year, BUFR’s +2.452 billion USD and BUFF’s +140.85 million USD in inflows dwarf AUEIX’s -732.20 million USD outflow, a net flow difference of +3.325 billion USD toward buffered ETFs.

This asset shift supports the hypothesis that AQR is losing investors to buffered ETFs, whose structured stability (2022 drawdowns of 4-5%, BufferLABS 100 Index at 7%) resonated more than AUEIX’s defensive equity approach (2022: -10%). The strong net-of-fee performance of BUFR, BUFF, and the BufferLABS 100 Index indicates that their options strategies are not prohibitively expensive, as high costs would have eroded returns and deterred inflows. Instead, their inflows reflect investor confidence in their cost-effective protection and upside potential. The broader market trend reinforces this: nontraditional-equity funds, including buffered ETFs, collected $8.2 billion in inflows in early 2025, reflecting strong demand for downside protection strategies. AQR’s claim that buffered ETFs are an “investment failure” may reflect frustration with this competitive pressure, as investors increasingly favor the predictability buffered ETFs offer.

Behavioral Value for Risk-Averse Investors

AQR dismisses buffered ETFs’ “comfort” as costly, but this predictability is a tangible benefit for risk-averse investors, a need AQR overlooks by focusing on raw returns. BUFR and BUFF’s defined buffers—10% and 15%, respectively—capped 2022 losses at 4-5%, and the BufferLABS 100 Index limited losses to 7%, helping investors stay invested through volatility, including the sharp drop in early 2025, with all results net of fees and trading expenses. AUEIX’s 10% loss in 2022, while better than SPY’s 18%, lacked this predictability, likely contributing to its outflows. The 80/20 portfolio’s 14% drawdown in 2022 could have triggered panic-selling, missing 2023’s 20.99% gain. BUFR, BUFF, and the BufferLABS 100 Index provided continuous protection at a reasonable cost, as evidenced by their net-of-fee performance, driving inflows as investors sought stability in uncertain markets. This downside protection likely keeps investors invested, thereby mitigating the risk of emotional capitulation.

Conclusion: Buffered ETFs Are Far From a Failure

AQR’s claim on Bloomberg TV that buffered ETFs are an “investment failure” does not withstand scrutiny. BUFR and BUFF outperformed the 60/40 stocks-bonds portfolio (40.14% from 2020-2025) and mitigated drawdowns better than the 80/20 stocks-cash portfolio (60.26%) and AUEIX (46.59%), delivering superior risk-adjusted returns and stability, all net of fees and trading expenses. The BufferLABS 100 Index, with an 18.08% return from 2022 to April 2025, further supports the effectiveness of buffered strategies, aligning closely with BUFR (19.99%) and BUFF (19.92%) while outperforming the 60/40 portfolio (12.26%) over the same period. If their options strategies were too expensive, the impact would be evident in their net-of-fee performance, but their strong returns and competitive Sharpe ratios show otherwise, highlighting the efficiency of their approach. Their combined +5.25 billion USD in inflows, contrasted with AUEIX’s -4.5 billion USD in outflows, suggest AQR’s criticism may stem from competitive pressure as investors shift assets to buffered ETFs that better meet their need for downside protection. Buffered ETFs are not a universal solution, but for risk-averse investors—particularly retirees or those making systematic withdrawals—they offer a valuable tool that AUEIX’s defensive equity approach cannot replicate. BufferLABS urges AQR to recognize the complementary role buffered ETFs play in modern portfolios rather than dismissing them outright.

Disclosure: This blog post is provided for informational and educational purposes only and does not constitute investment advice, financial advice, or a recommendation to buy or sell any securities or financial instruments. The information presented herein is based on historical data and analysis conducted by BufferLABS and should not be considered a guarantee of future performance. Past performance is not indicative of future results. Investors should conduct their own research and consult with a qualified financial advisor before making any investment decisions. BufferLABS and its affiliates are not responsible for any investment decisions made based on this content, nor for any losses or damages arising from the use of this information. The opinions expressed are those of BufferLABS as of the date of publication and are subject to change without notice.

Comments